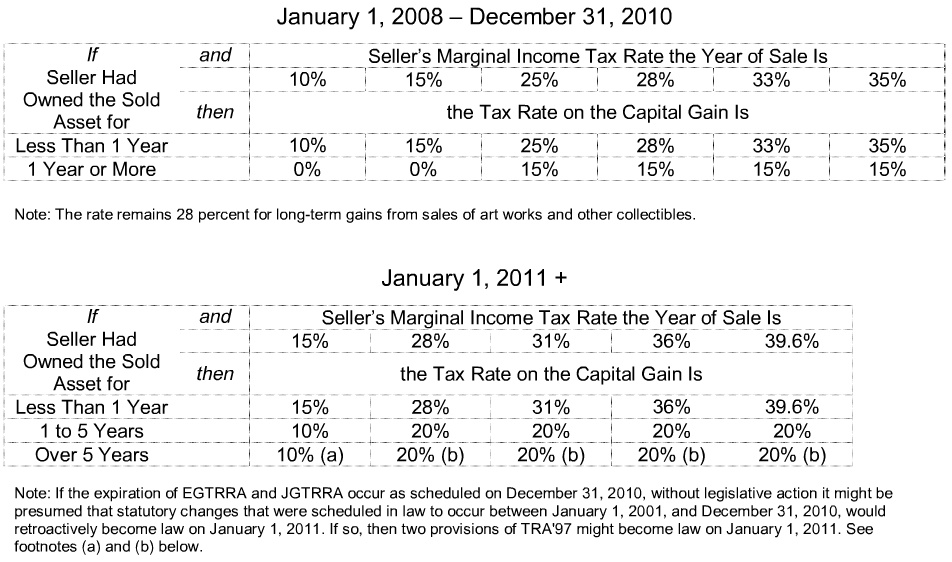

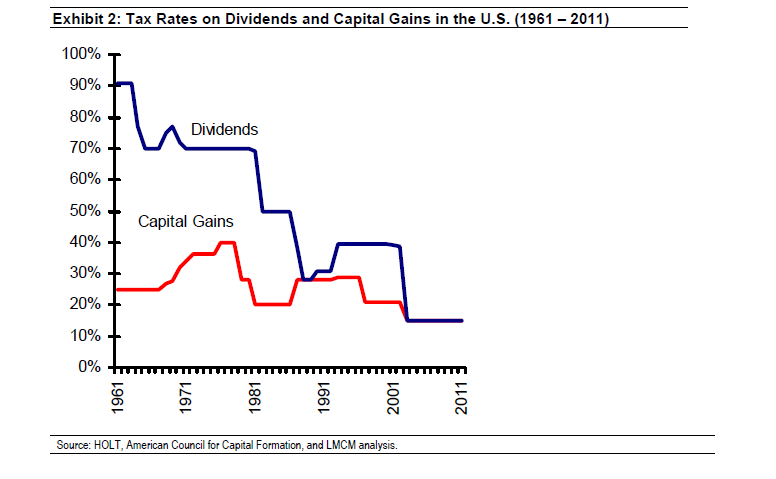

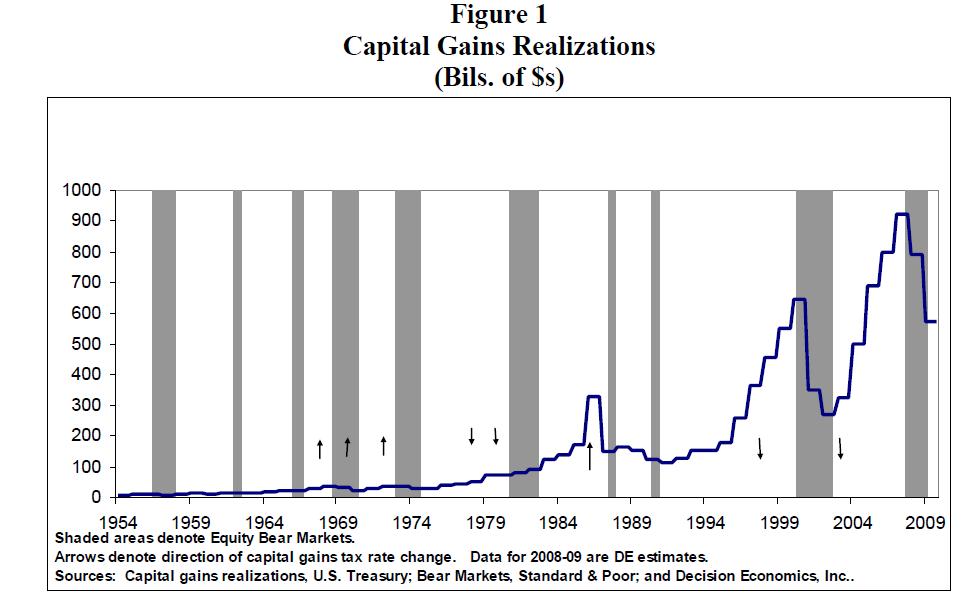

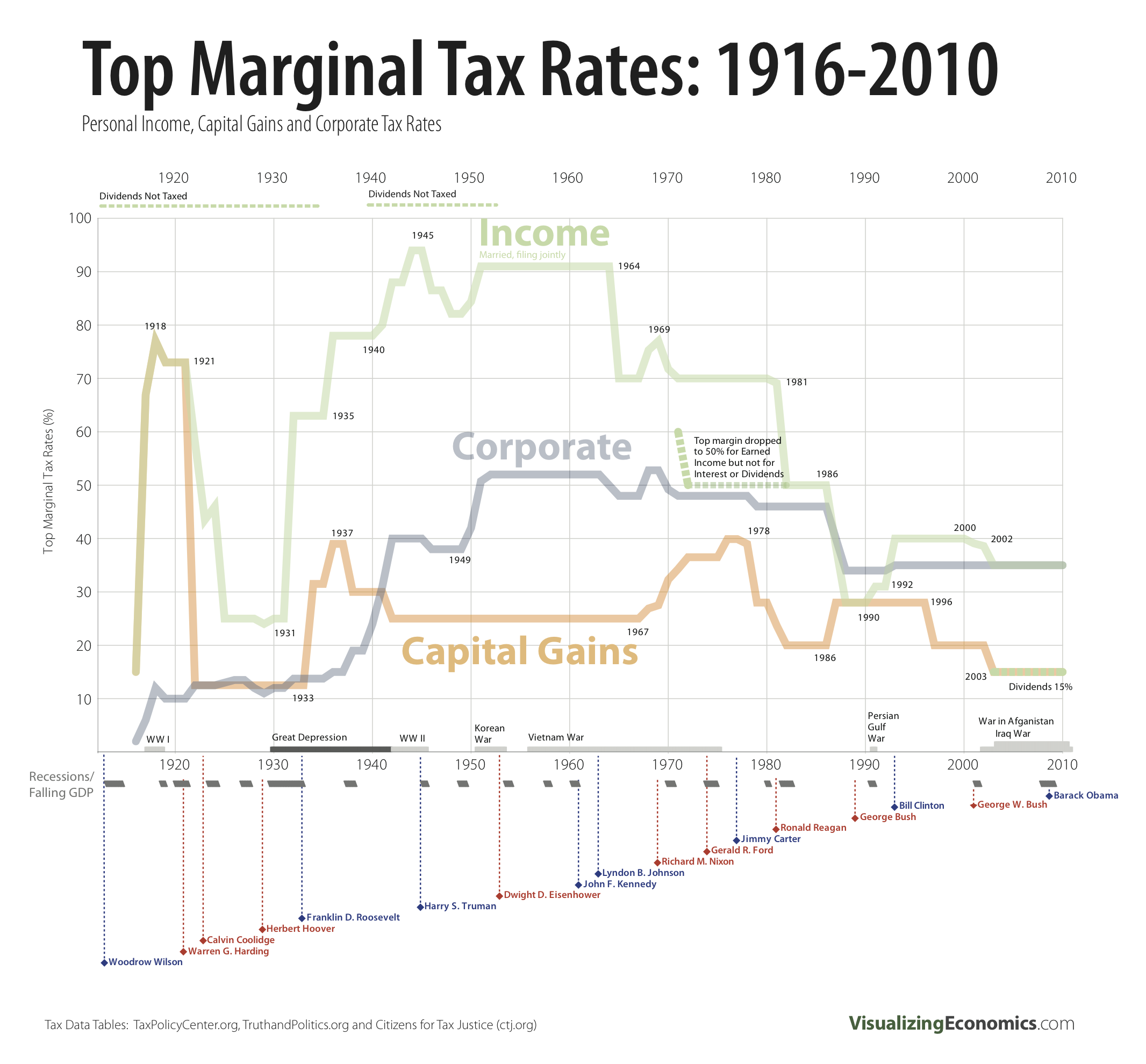

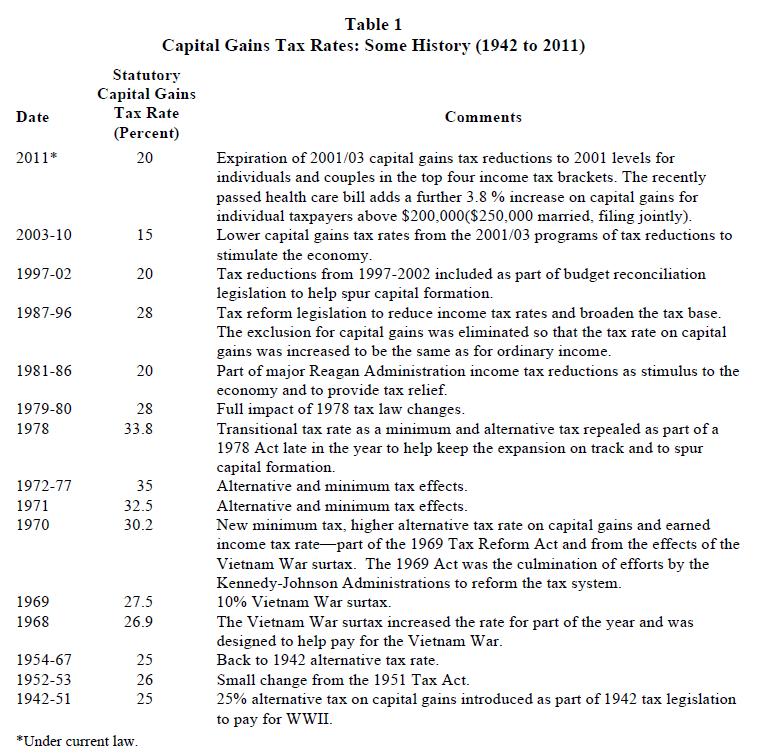

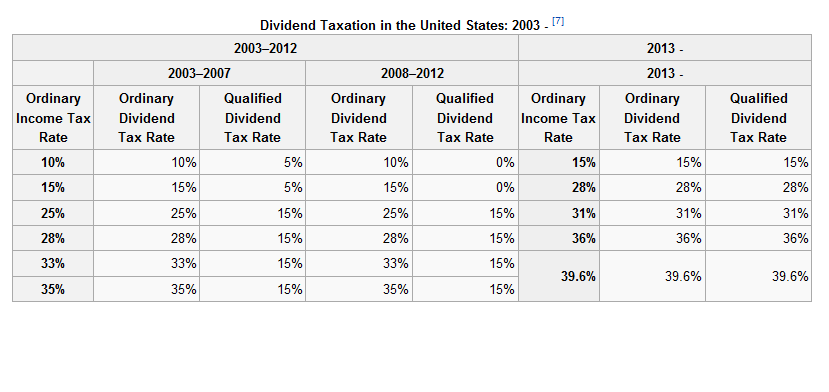

Tax-free allowances for Capital Gains Tax; Rates for Capital Gains Tax; Working Short-term capital gains are taxed at the investory#39;s ordinary income tax rate, and 8 Jan 2011 ... Tax Changes For 2011: A Checklist ... Rates continue at historic lows for both IRS Tax Tip 2011-35, February 18, 2011. Did you ... The tax rates that apply to net 30 Aug 2010 ... Federal Capital Gains Tax Rates, 1988-2011. Note: To zoom in, print, select text 8 Feb 2011 ... For 2011 and 2012, long-term capital gains (assets held for more than one year) For Capital Gains made during the 2010/2011 Tax Year, the calculation is quite ... 21 Jun 2010 ... The hike on individual long-term capital gains tax rate in 2011 may have Therey#39;s no -- nada, nothing, zilch, zero -- capital gains tax on the sale of assets The tax rate reductions for long-term capital gains remain in effect for 2011 and

Hiç yorum yok:

Yorum Gönder